#11 - BUIDL an Orderbook-based DEX on Solana in 2 hours

Author: @harry830622, @ironaddicteddog

[Updated at 2022.08.25]

See the example repo here

TL; DR

DEX is an essential infrastructure for any DeFi ecosystem. Currently almost all exchanges in TradFi and CEXs are orderbook-based while major DEXs on Ethereum are AMMs due to some of Ethereum’s undesirable nature such as low TPS and high transaction fee, etc.

However, on Solana, a blockchain fundamentally more advanced than Ethereum, orderbook-based DEXs become much more practical.

In this session, we are going to BUIDL an orderbook-based DEX on Solana.

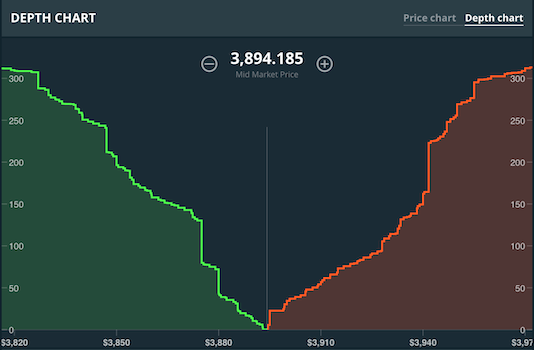

What is Central Limit Order Book (CLOB)

From Wikipedia:

A central limit order book (or CLOB) is a trading method used by most exchanges globally.

It is a transparent system that matches customer orders (e.g. bids and offers) on a price time priority basis.

The highest (best) bid order and the lowest (cheapest) offer order constitutes the best market or the touch in a given security or swap contract.

Customers can routinely cross the bid/ask spread to effect immediate execution.

CLOB vs AMM

Serum: The Most Crucial Financial Infrastructure of Solana

Serum DEX is the matching engine powering Solana-based financial projects

Serum can power:

Spot Market

Derivatives Market (Zeta Markets / PsyOptions / off-piste / HXRO)

Liquidations (Jet Protocol / Tulip / Parrot)

Asset Management (Solrise / Nova Finance)

AMMs (Raydium / Atrix / Cyclos)

In-game NFT markets (Star Atlas / DeFi Land / Aurory / OpenEra)

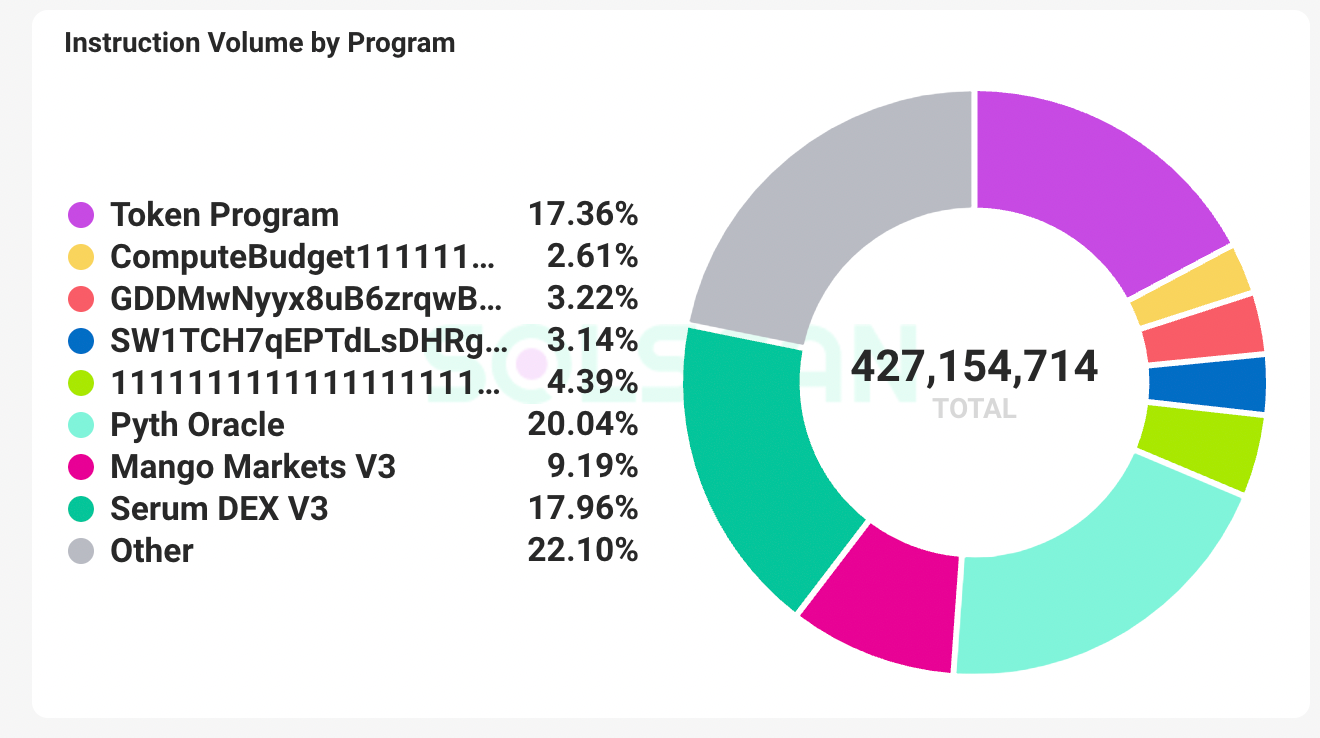

Dominance of Serum

It takes ~30% of instruction volume on Solana

Some analytics:

Ecosystem

Raydium: AMM Built on Top of CLOB

Problem

High gas fees

Speed

High slippage on large orders

Fragmented liquidity

Solution

From Raydium lightpaper:

Unlike other AMM platforms, Raydium provides on-chain liquidity to a central limit order book, meaning that Raydium’s users and liquidity pools have access to the order flow and liquidity of the entire Serum ecosystem, and vice versa.

Raydium is a pure market maker which takes the tokens locked in it to create a series of orders at different price points and sizes to provide liquidity.

It creates orders using the constant product invariant. This equation has the special property that it is stateless and given any two tokens, without any information about their relative prices or value, it can provide “infinite” liquidity to traders.

Raydium utilizes this equation and prices orders on the orderbook according to the Fibonacci sequence to provide up to 20 orders at a variety of prices.

Components of Serum

Main actions

PlaceOrder

MatchOrder

CancelOrder

SettleFund

ConsumeEvent

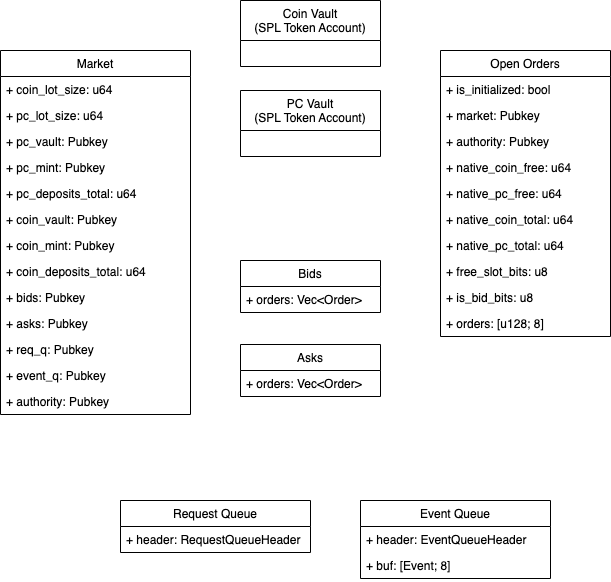

Architecture

Overview

Market is like a trading pair in CEX

Coin: Base Asset

PC(Primary Currency): Quote Asset

Open Orders is like your account in CEX

Vaults are the token accounts for the matching engine

Bids/Asks compose an order book

Request Queue is like a job queue

Event Queue records the events such as orders filled, orders cancelled, etc.

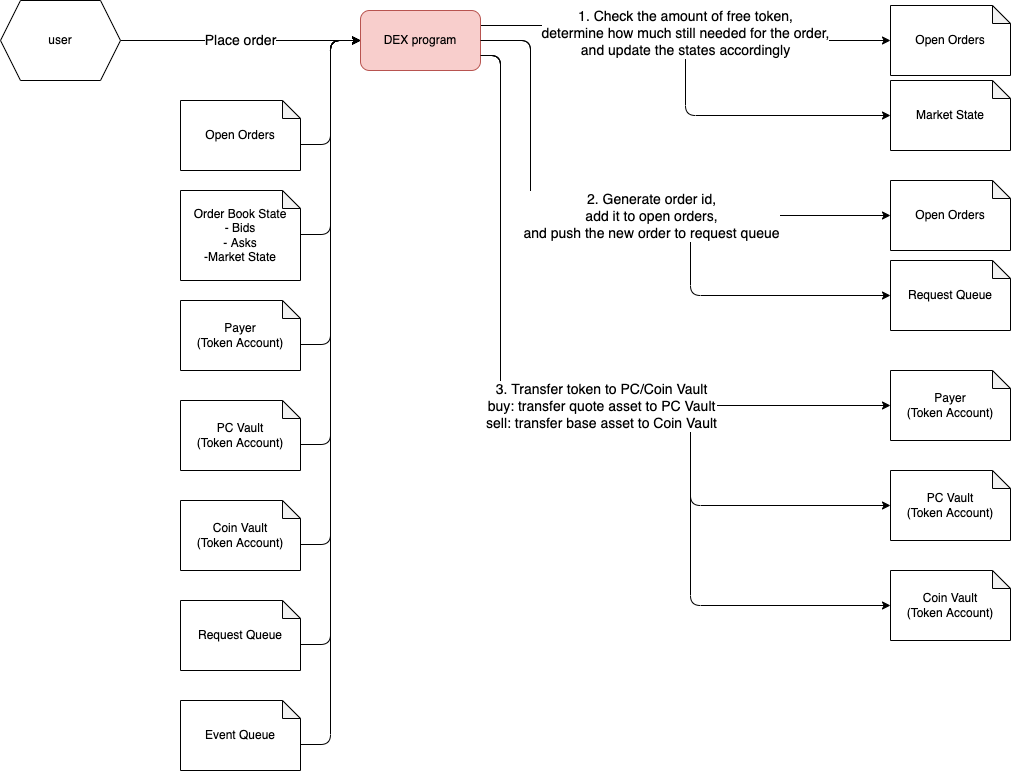

Place Order

Side

Bid

Ask

Order Type

Limit

Post Only

IOC

Init an open orders if there is none

Transfer funds to the vaults if the current deposit is not enough

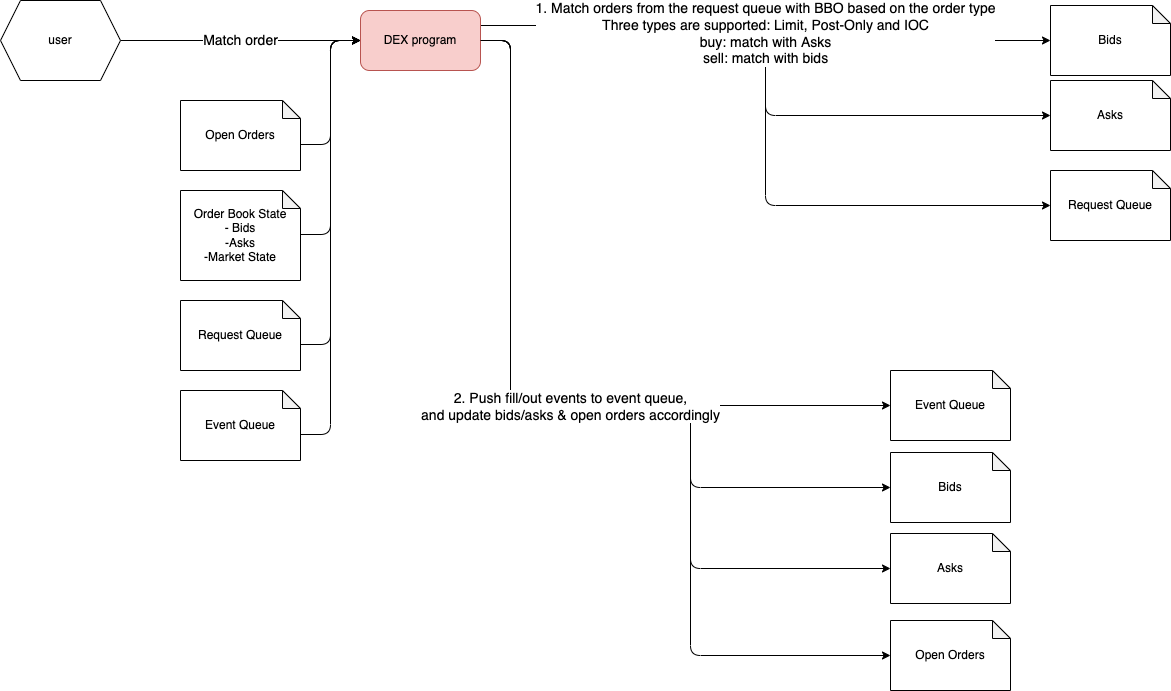

Match Order

Match the order with orders on the order book

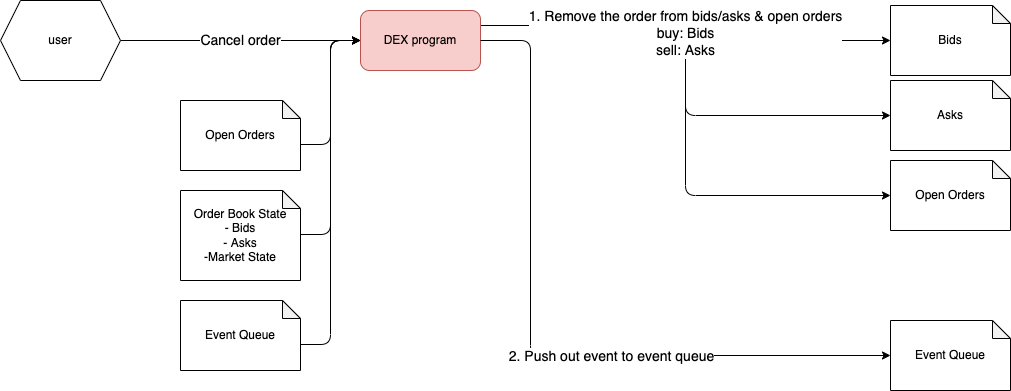

Cancel Order

Cancel the order placed before

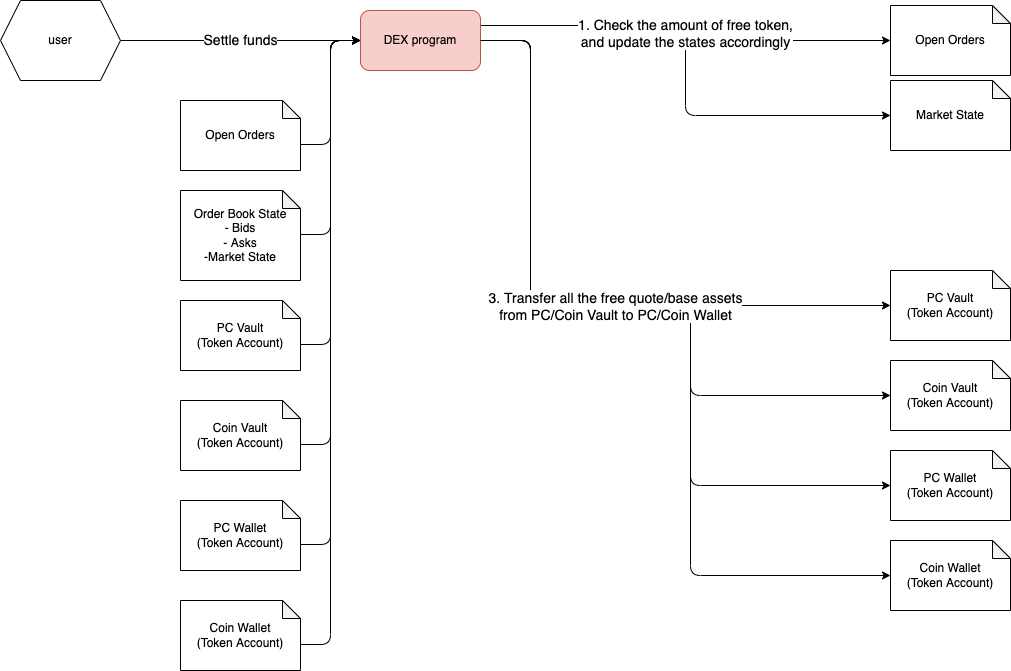

Settle Fund

Transfer funds out of the vaults to your own wallets

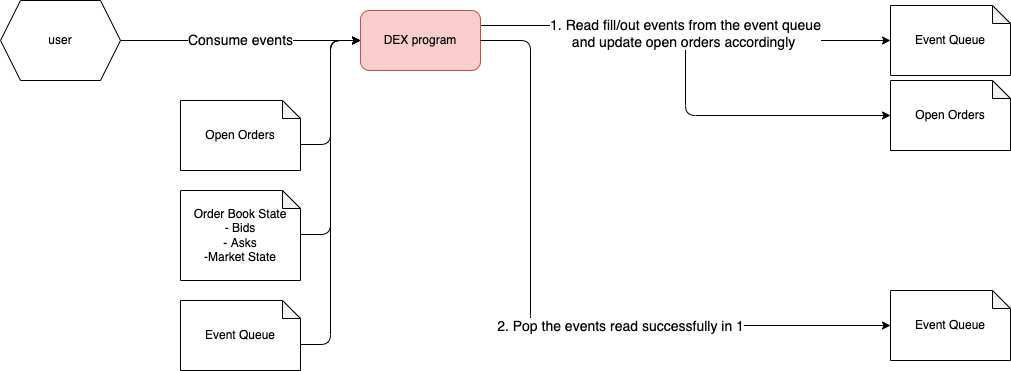

Consume Event

To know what happened in the DEX

References

https://uniswap.org/blog/uniswap-v3-dominance#comparison-of-uniswap-v3-versus-centralized-exchanges

https://docs.projectserum.com/

https://projectserum.medium.com/serum-srm-and-the-ecosystem-part-1-2742f6a24597

https://projectserum.medium.com/serum-srm-and-an-ecosystem-for-the-future-part-2-91398e75ce27 https://projectserum.medium.com/calling-all-devs-serum-srm-and-an-ecosystem-for-the-future-part-3-ae7adbf4466e

https://raydium.io/Raydium-Litepaper.pdf

Last updated